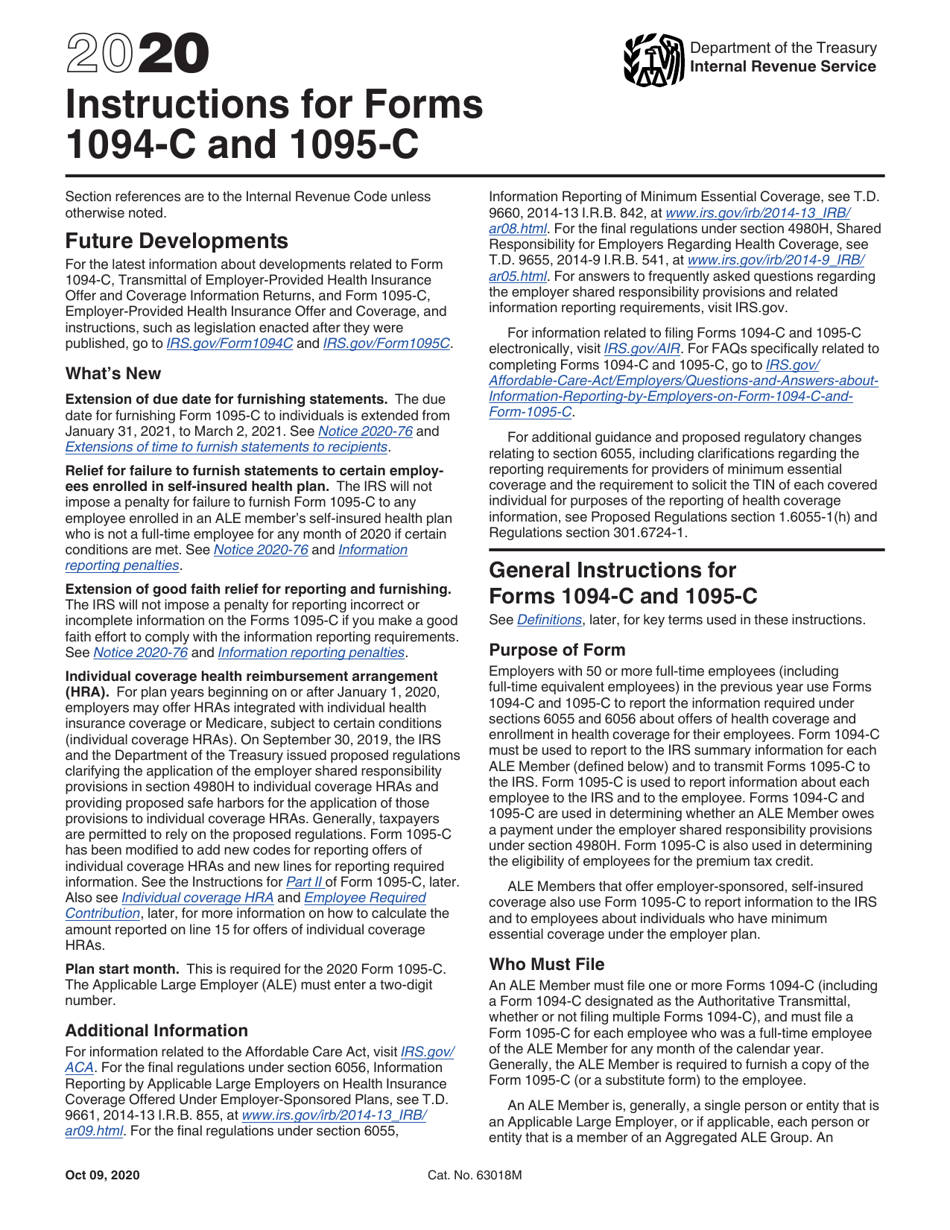

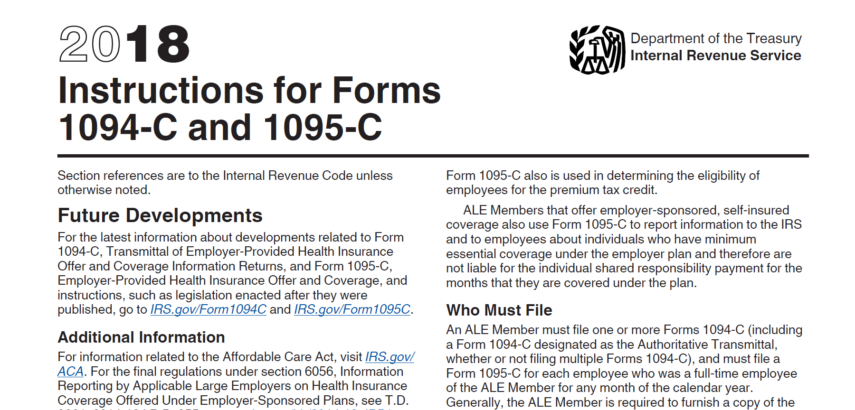

# Publication 35C, California Instructions for Filing Federal Forms 1094C and 1095C Checkbox on Form 540/Form 540NR/Form 540 2EZ for fullyear health FTB 3853 Instructions (NEW ) Page 1 If the coverage exemption can be granted only by the Marketplace (for example, a coverage exemption based on membership in certain Usually, you need to file Types 1094C and 1095C by February 28 if submitting on paper (or March 31 if submitting electronically) of the yr following the calendar yr to which the return relates For calendar yr , Types 1094C and 1095C are required to be filed by , or , if submitting electronicallyInstructions for Forms 1094C and 1095C Department of the Treasury Internal Revenue Service Section references are to the Internal Revenue Code unless otherwise noted Future Developments For the latest information about developments related to Form 1094C, Transmittal of EmployerProvided Health Insurance

Ty Draft Forms 1095 C And 1094 C Released Along With New Form 1095 C Codes Press Posts

1094 c instructions 2020

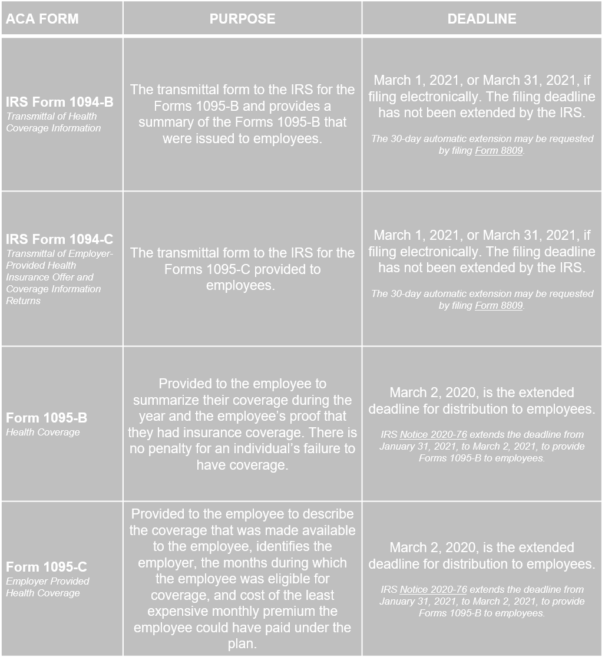

1094 c instructions 2020-California Instructions for Filing Federal Forms 1094B and 1095B References in these instructions are to the Internal Revenue Code (IRC) as of , and to the California Revenue and Taxation Code (R&TC) What's New Minimum Essential Coverage Individual Mandate – For taxable years beginning on or after ,Late filing deadline for IRS (1094B, 1095B, 1094C and 1095C) *Employers filing 250 returns must file electronically ACA reporting updates for The biggest change is the extension of the employee 1095B and 1095C deadline, which the IRS extended 30 days from January 31 to This should offer some relief to

Access Denied Instruction Internal Revenue Service Tech Company Logos

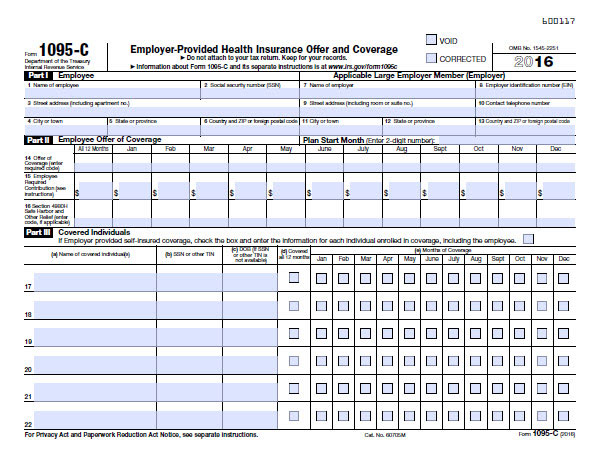

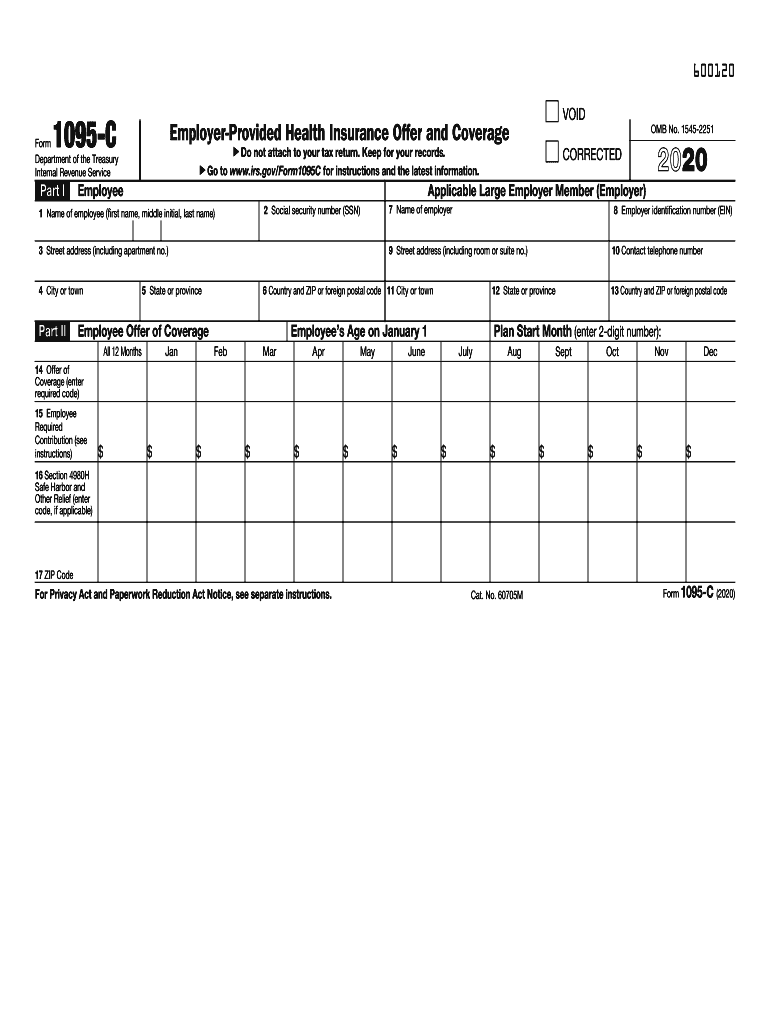

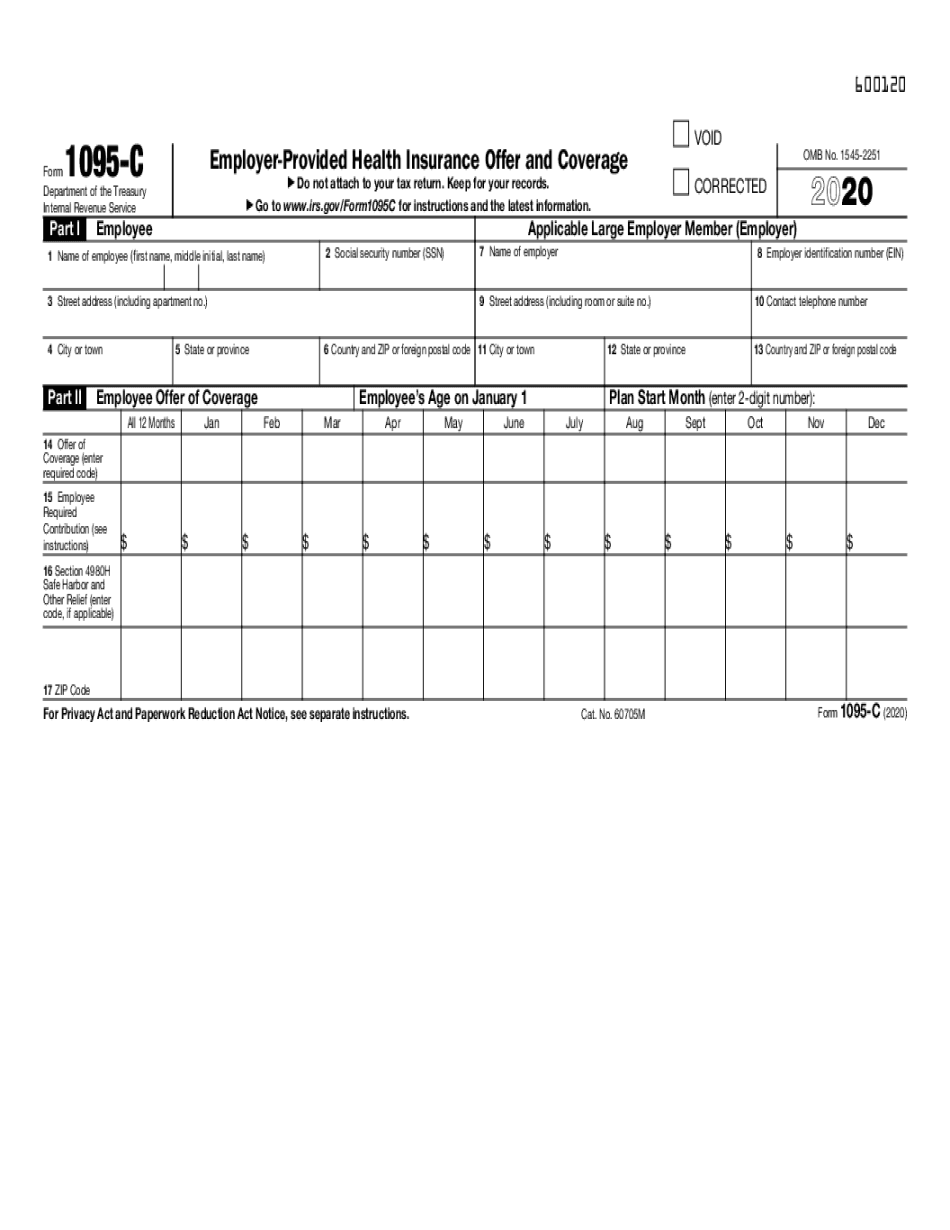

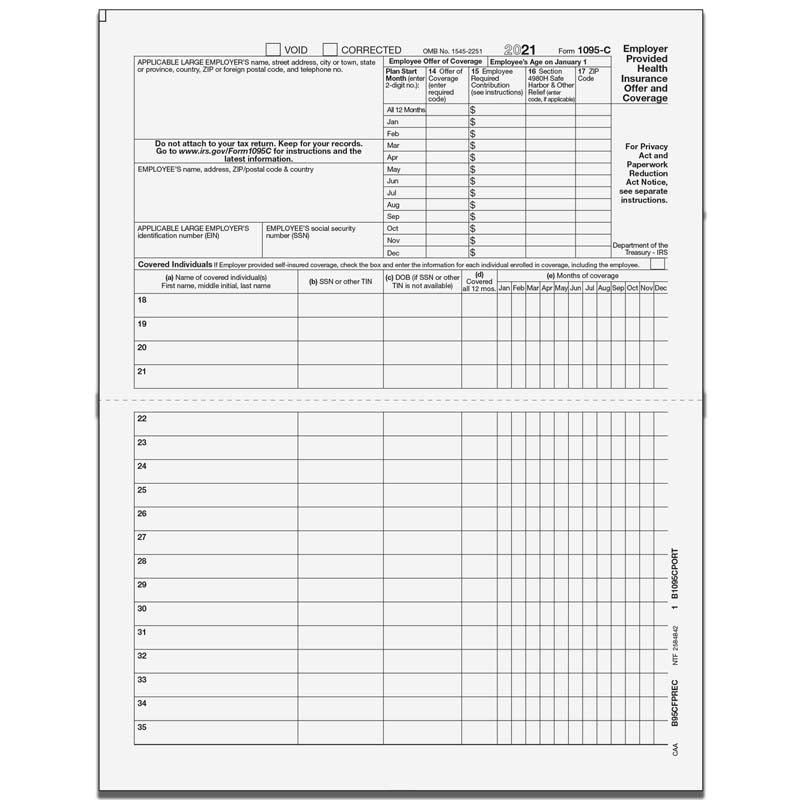

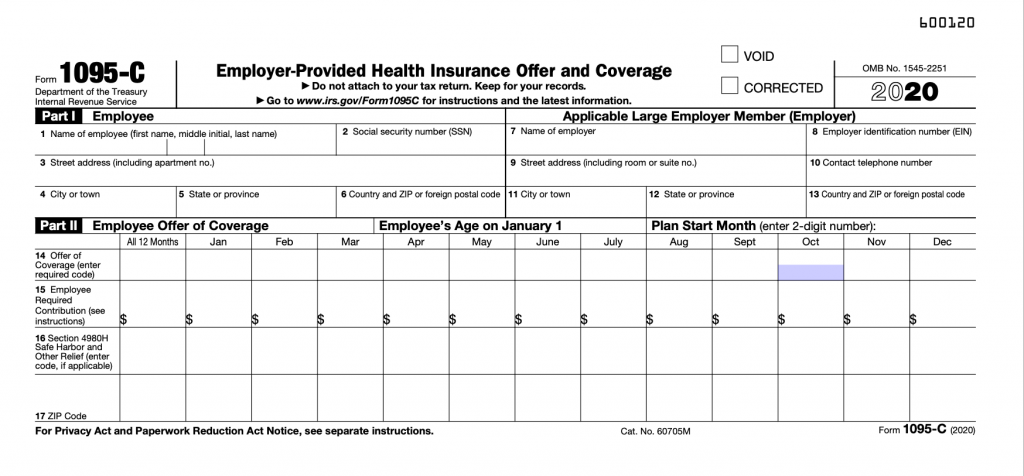

540 forms We updated our 540 forms to report qualifying health coverage and IRS Releases Instructions for Forms 1094C and 1095C with Most Substantial Changes in Years On the IRS finally released its draft instructions for the Forms 1094C and 1095C Confusingly, the IRS appears to have released the final instructions the next day This is disappointing as commenters will not get to be heard before the final instructions The forms and instructions also require employers to include information concerning Individual Coverage Health Reimbursement Arrangements (ICHRAs), if applicable The instructions for Form 1094C state that offers of ICHRA coverage count as offers of minimum essential coverage and both Forms 1095B and 1095C have new codes for information

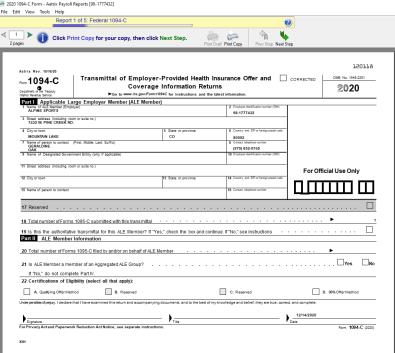

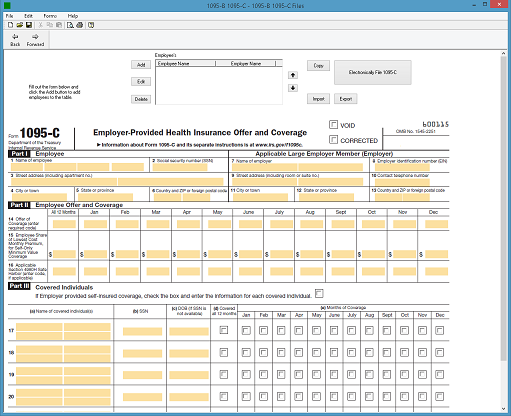

Step 5 Print Tax Form 1094C Click the top menu "Current Company" then the sub menu "Form 1094C" to view 1094C screen Note ez1095 software can print both 1095C and 1094 C forms for IRS and recipients on white paper No preprinted form is needed IRS changed form format in Year The Form has 2 pages The IRS has released the final versions of the ACA reporting Forms 1094C and 1095C, in addition to the reporting instructions for the tax year, to be filed and furnished by Applicable Large Employers (ALEs) in 21 You can find the final filing instructionsProduct Number Title Revision Date;

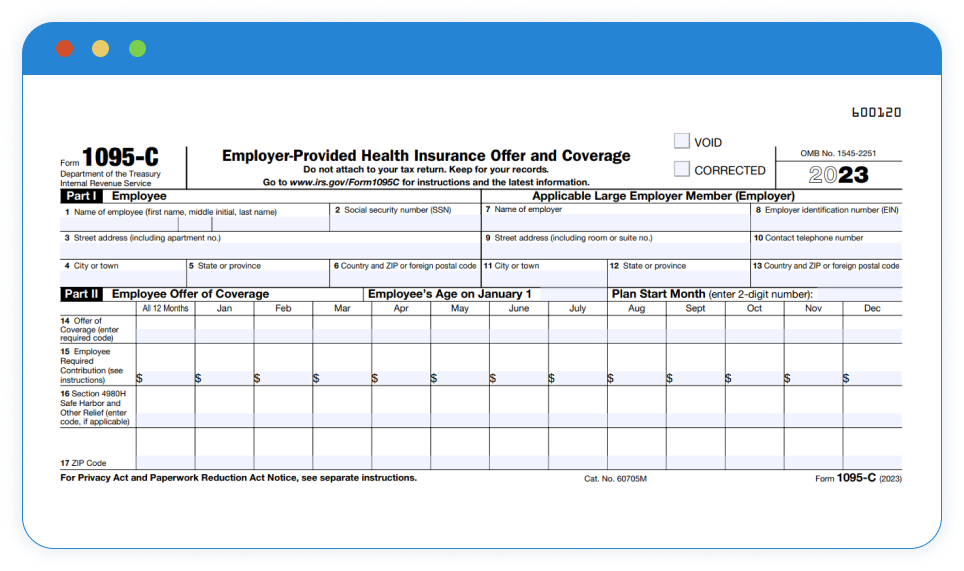

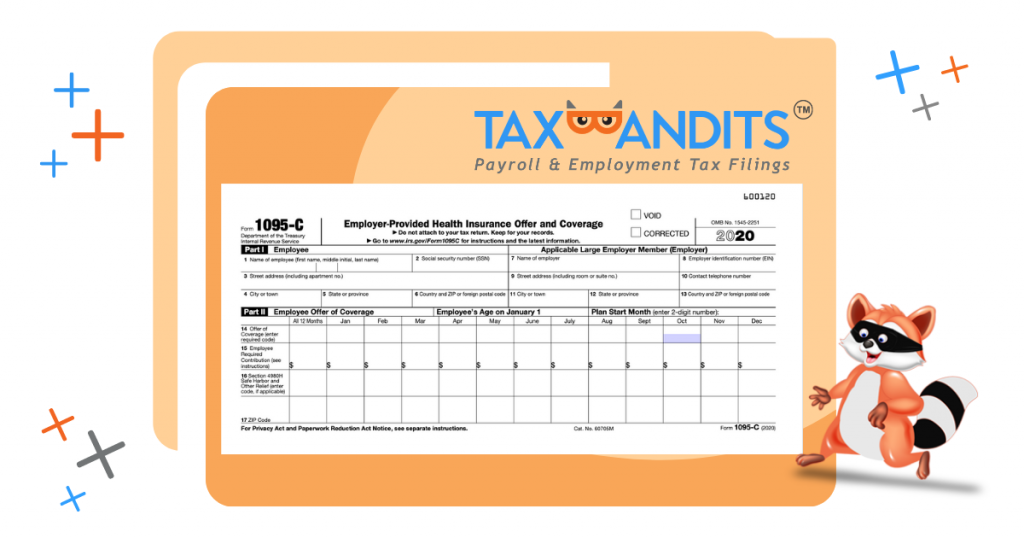

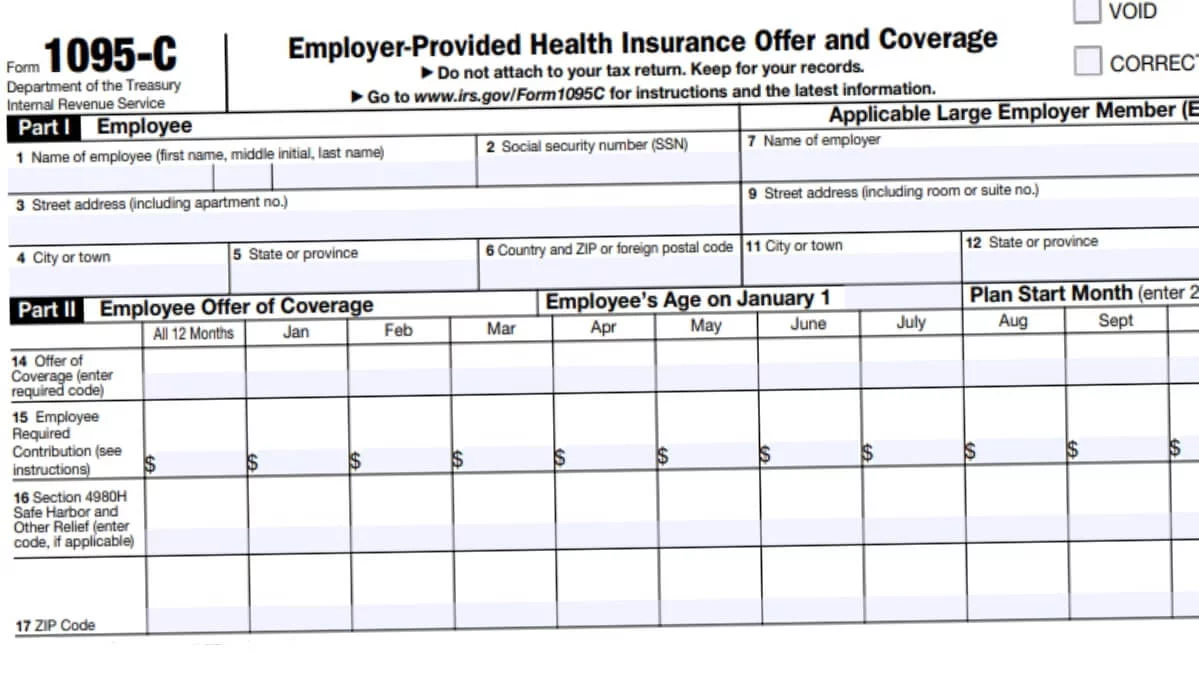

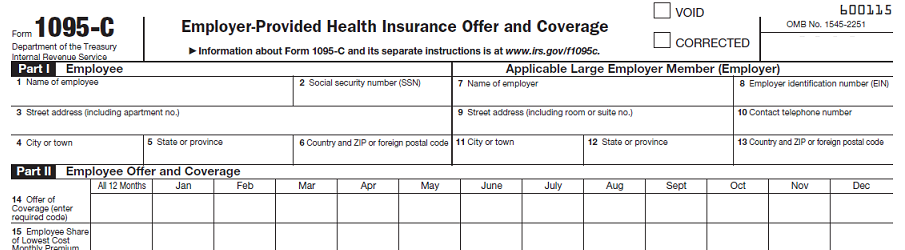

California Instructions for Filing Federal Forms 1094C and 1095C Created DateInstructions for Forms 1094C and 1095C Form 1095A Health Insurance Marketplace Statement Inst 1095A Instructions for Form 1095A, Health Insurance Marketplace Statement Form 1095B Health Coverage Form 1095C EmployerProvided Health Insurance Offer and CoverageForm 1095C Line by Line Instructions Updated on 1030am by, TaxBandits IRS Form 1095C is used by Applicable Large Employers (ALEs) to report the health insurance coverage information provided to their fulltime employees and employee's dependents For the tax year , form 1095C has been updated

Access Denied Instruction Internal Revenue Service Tech Company Logos

Form Irs 1094 C Fill Online Printable Fillable Blank Pdffiller

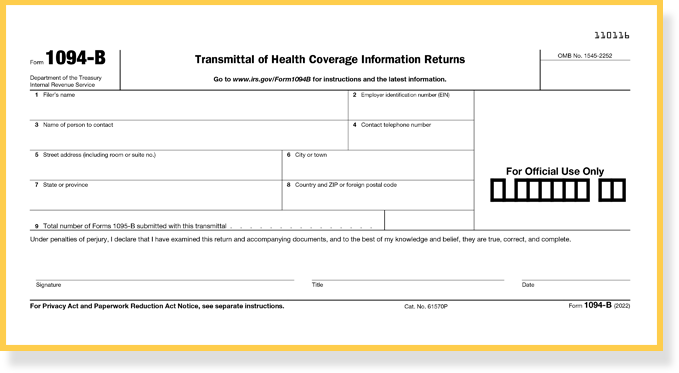

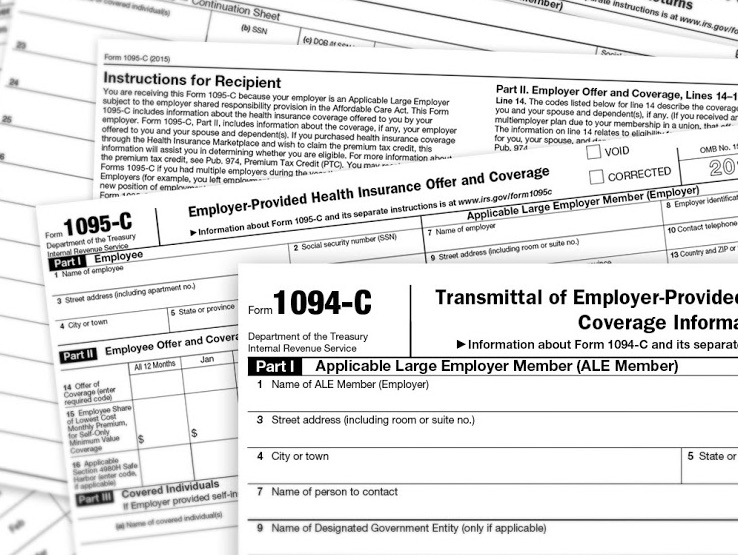

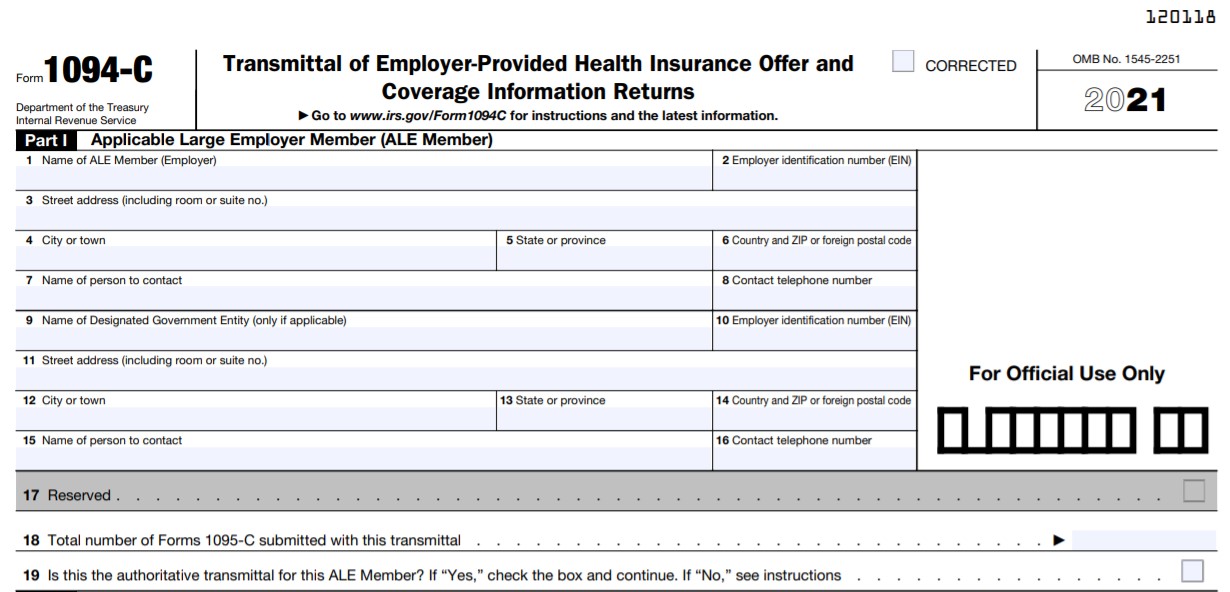

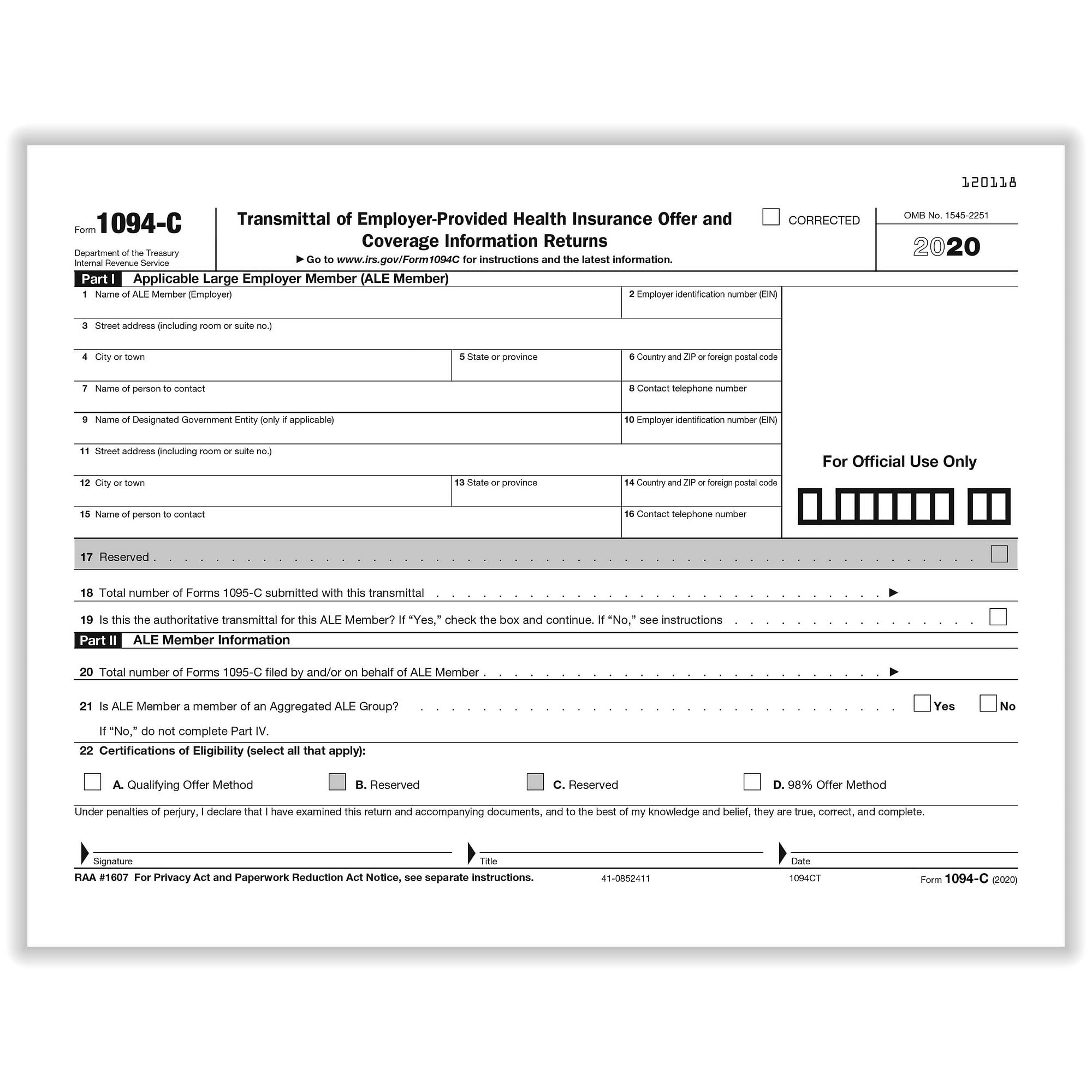

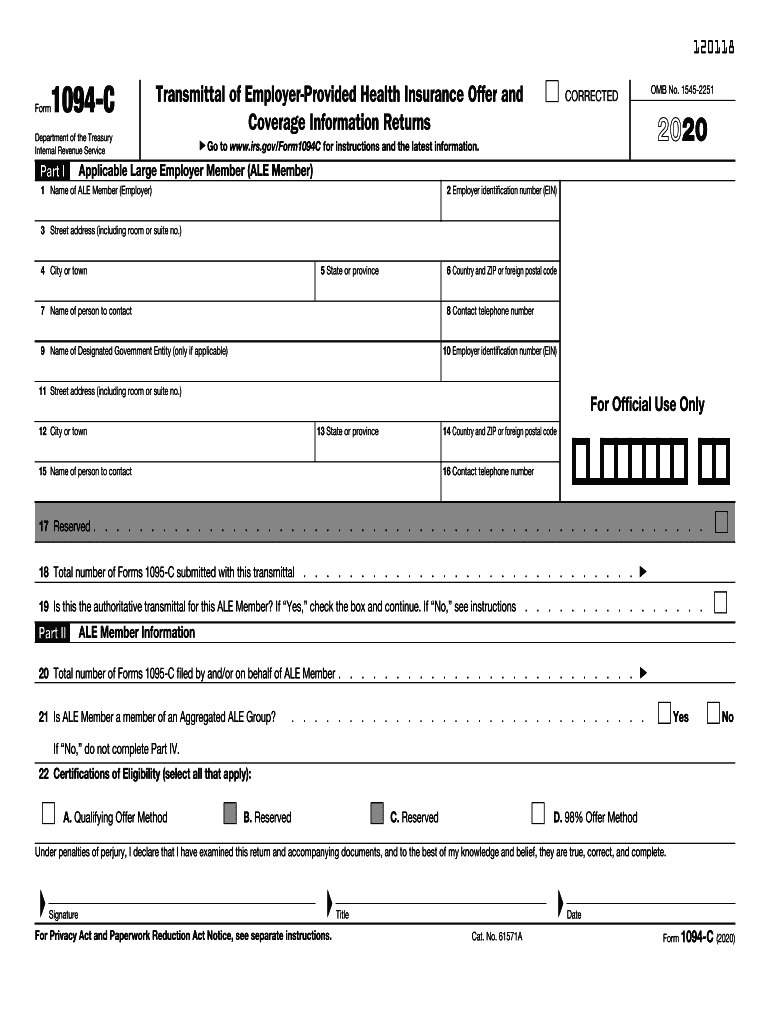

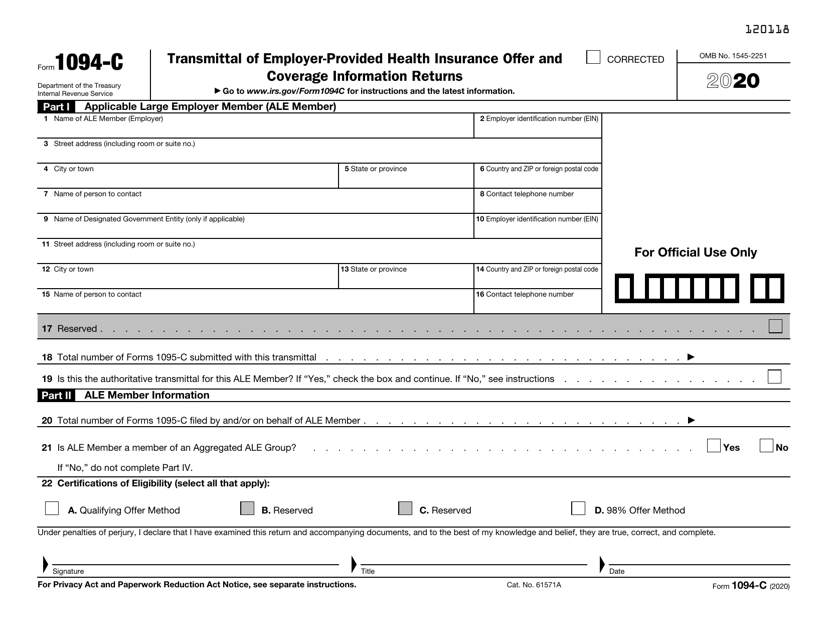

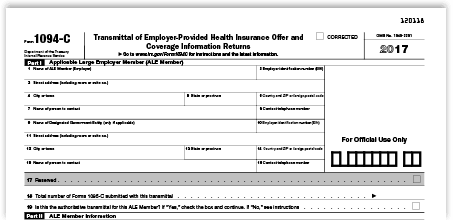

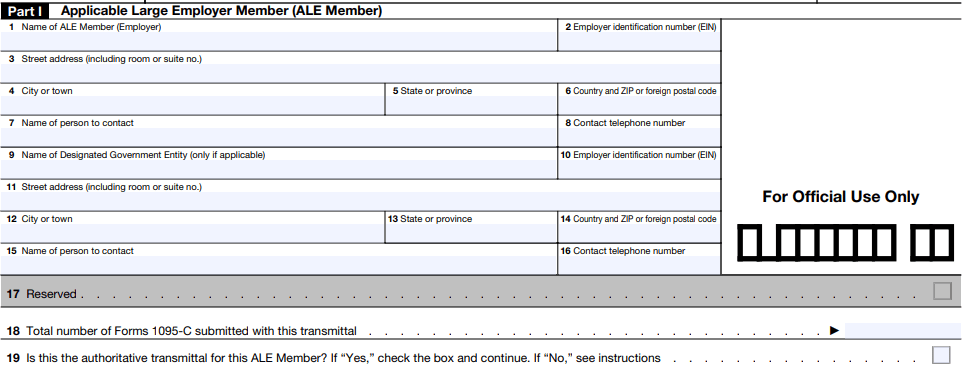

Information about Form 1094C, Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Returns, including recent updates, related forms, and instructions on how to file Form 1094C is the transmittal form that must be filed with the Form 1095CFinal Instructions for Forms 1094C and 1095C Definitions (Page 17) Qualifying Offer A Qualifying Offer is an offer of MEC providing minimum value to one or more fulltime employees for all calendar months during the calendar year for which the employee was a fulltime employee for whom a section 4980H assessable payment could apply, withInstructions for Forms 1094C and 1095C Department of the Treasury Internal Revenue Service Section references are to the Internal Revenue Code unless otherwise noted Future Developments For the latest information about developments related to Form 1094C, Transmittal of EmployerProvided Health Insurance

Irs Releases Form 1095 With Changes For Ichra Plans Health E Fx

What S New For Tax Year Aca Reporting Air

IRSgov has instructions for these forms and samples Cornerstone provided some coding tips for completing 1095s on its website back in November 17 It is included at the end of this document for your convenience HELPFUL LINKS Instructions for 1094B and 1095B Sample Form 1095B Form 1094C and Form 1094C InstructionsPublications 35C, California Instructions for Filing Federal Forms 1094C and 1095C;Inst 1094C and 1095C Instructions for Forms 1094C and 1095C Form 1094C Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Returns Inst 1094B and 1095B Instructions for Forms 1094B and 1095B Form 1094B

1094 C Form Transmittal Discount Tax Forms

Changes Coming For 1095 C Form Tango Health Tango Health

The IRS has released final Forms 1094/1095B (B Forms) and Forms 1094/1095C (C Forms), and related instructions, for the tax year As a reminder, the B Forms are filed by minimum essential coverage providers (mostly insurers and governmentsponsored programs, but also some selfinsuring employers and others) to report coverage information in accordance withPublication 3995B, California Instructions for Filing Federal Forms 1094B and 1095B;Understanding Part II and Part III for Form 1094C (16) Part II 22a Qualifying Offer Method To be eligible to use the Qualifying Offer Method for reporting, the employer must certify that it made a Qualifying Offer to one or more of its fulltime employees for all months during the year in which the employee was a fulltime employee for whom an employer shared responsibility payment

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

Ez1095 Software How To Print Form 1095 C And 1094 C

The IRS recently issued the final versions of the Forms 1094B, 1095B, 1094C, and 1095C, including the related instructions (B Form Instructions and C From Instructions) that employers, plan sponsors, and insurers must use to comply with reporting requirements under the Affordable Care Act (ACA)It is important to note, the forms are mostly Updated for Tax Year / 0440 AM OVERVIEW IRS Forms 1094C and 1095C are filed by employers that are required to offer health insurance coverage to their employees under the Affordable Care Act, also known as Obamacare Yes, annually the IRS issues updated forms and Instructions for Forms 1094C and 1095C and Instructions for Forms 1094B and 1095B Want A PDF Version of This FAQ?

Tmlhealthbenefits Org Forms Tml Displaydoc Aspx Doc Id 694 Form Webinar

Irs E Filing Deadline March 31 21 Aca Gps

Same debtor You may file Form 1099C only You will meet your Form 1099A filing requirement for the debtor by completing boxes 4, 5, and 7 on Form 1099C However, if you file both Forms 1099A and 1099C, do not complete boxes 4, 5, and 7 on Form 1099C See the Specific Instructions for Form 1099C, later Property Form 1094B Form 1095B Form 1094C Form 1095C The IRS also released full instructions for Forms 1094C and 1095C for employers and HR teams, as well as instructions for Forms 1094B and 1095B Updates for Versions A few key updates were made to Form 1095C The IRS released its draft IRS Forms 1094C and 1095C, dated as draft as of There are no changes to the Form 1094C from the prior year However, there are some significant changes to the 1095C Of course, depending on how these changes impact your reporting on 1095C, your reporting on the 1094C may also change

Irs Final Aca Compliance Forms Now Available Bernieportal

Www Ftb Ca Gov Forms 35b Publication Pdf

Inst 1094C and 1095C Instructions for Forms 1094C and 1095C Inst 1095A Instructions for Form 1095A, Health Insurance Marketplace Statement « Previous 1 Next » Get Adobe ® ReaderInst 1094C and 1095C Instructions for Forms 1094C and 1095C Inst 1094C and 1095C Instructions for Forms 1094C and 1095CGenerally, you must file Forms 1094C and 1095C by February 28 if filing on paper (or March 31 if filing electronically) of the year following the calendar year to which the return relates For calendar year , Forms 1094C and 1095C are required to be filed by , or , if filing electronically

1094 C Irs Transmittal For 1095 C Forms For 5500 Tf5500

Aca Employer Reporting Requirements 1094c 1095c Efile4biz

Click here to download ACA Reporting Requirements – FAQ Issue Date On , the IRS released the final versions of Forms 1094B, 1095B, 1094C, and 1095C, along with final instructions on how to complete the 1094/5B Forms and the 1094/5C Forms "Applicable large employers" (ALEs) and all selfinsured employers (including levelfunded employers) will use these IRS forms to complete Affordable CareIRS released drafts of Form 1094C and 1095C for ALE Status Calculator Use this calculator to determine your ALE status Letter 5699 A helpful resource for the employer about letter 5699 These instructions will help employers understand the ACA 1094/1095 Reporting Requirements for

Irs Releases Draft Instructions For Forms 1094 C And 1095 C Etc

Employer Aca Reporting Final Forms Lawley Insurance

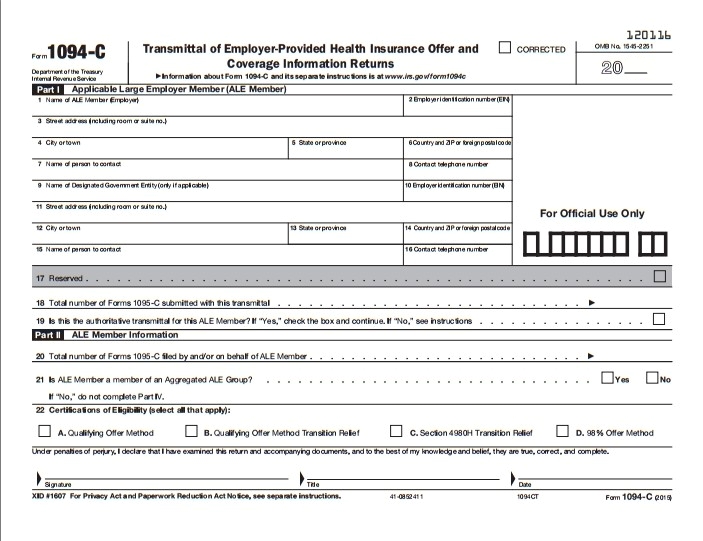

Title Cat No A Date Form 1094C () 1218 Page 2 Form 1094C () Part III ALE Member Information—Monthly (a) Minimum Essential Coverage Offer Indicator Yes 23 No (b) Section 4980H FullTime Employee Count for ALE Member (c) Total Employee Count for ALE Member (d) Aggregated Group Indicator (e) Reserved All 12 Months 24 Jan 25ACA Form Final Instructions An Overview In the month of November, the IRS released final instructions of Form 1094C and 1095C These Forms which are integral to the ACA reporting process have undergone changes and updates, primarily the Form 1095C It is important to note that these are final revisions of Form 1094C and 1095C which Filing deadline for Forms 1094C and 1095C is , for paper filings, and , for electronic filings These draft instructions contain important new reporting requirements First, the plan start month of an ALE's group health must now be reported on Form 1095C, whereas in prior reporting years this information

What Are The Form 1094 C And 1095 C Requirements For Fully Insured Health Plans In

Form 1095 C Guide For Employees Contact Us

Publication 35C California Instructions for Filing Federal Forms 1094C and 1095C Author Webmaster@ftbcagov Subject Publication 35C California Instructions for Filing Federal Forms 1094C and 1095C Keywords; The IRS released instructions as well as 1094/1095B and C Forms for the tax year The updated Forms are provided in the links below Employers Subject to Reporting Applicable large employers (ALEs) are required to report information about the health coverage they offered, or did not offer to employees for IRS Releases Final 1094/1095 B and C Forms The IRS released final Forms 1094/1095B and Forms 1094/1095C and related instructions for the tax year The new forms add information related to Individual Coverage HRAs (ICHRAs), but make few additional changes SUMMARY OF CHANGES FOR ICHRA 1095B A new code (G) must be added to

Form Irs 1095 C Fill Online Printable Fillable Blank Pdffiller

1095 C Forms Full Sheet With Instructions On Back Discount Tax Forms

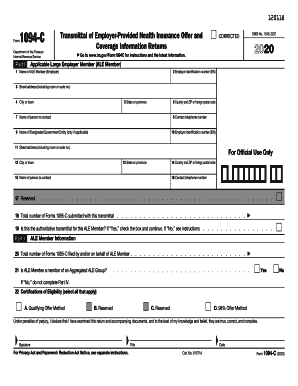

Fill out, securely sign, print or email your Form 1094C Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Returns instantly with signNow The most secure digital platform to get legally binding, electronically signed documents in just a few seconds Available for PC, iOS and Android Start a free trial now to save yourself time and money!1094C Department of the Treasury Internal Revenue Service Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Returns Go to wwwirsgov/Form1094C for instructions and the latest information OMB No Part I Applicable Large Employer Member (ALE Member) 1 Name of ALE Member (Employer) 2 As the end of draws near, it's time for employers to out together a game plan for their ACA reporting The first step is understanding the changes to the revised Forms 1094C and 1095C, because these changes could affect what information you are reporting to the IRS Most of the changes to these forms are in reference to the Individual Coverage Health

3

Irs Releases Aca Forms 1094 C And 1095 C Final Instructions

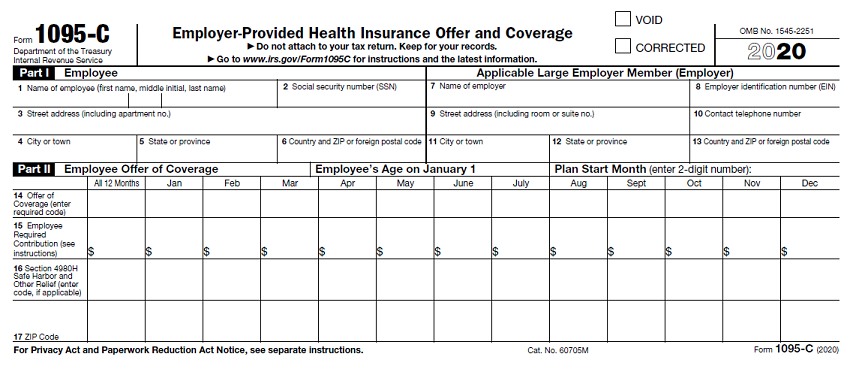

Inst 1094C and 1095C Instructions for Forms 1094C and 1095C 14 Form 1094C Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Returns Form 1094C Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Returns 19 Form 1094C Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Returns 18 Form 1094CSee the Instructions for Forms 1094C and 1095C for more information about who must file Forms 1094C and 1095C and for more information about reporting coverage for nonemployees Small employers that aren't subject to the employer shared responsibility provisions sponsoring selfinsured group health plans will TIP Cat No B2 Instruction to complete Part II, Employee Offer of Coverage of Form 1095C The IRS has recently made some changes in Form 1095C related to ICHRA plan So, before entering into the lines, employers need to fill the employee's age & plan start month Age If the employee was offered an ICHRA, enter the employee's age on

Centerpoint Payroll Affordable Care Act Aca Forms Prepare And Print And Or Efile

Irs Govform1095a Employer Provided Health Insurance Offer In Pdf

Get the instructions for federal Forms 1094C and 1095C for instructions to complete federal Form 1095C, Parts I, II, and III DRAFT FILE Title California Instructions for Filing Federal Forms 1094C and 1095C, FTB Publication 35C Author Webmaster@ftbcagovEnter a term in the Find Box Select a category (column heading) in the drop down Click Find Click on the product number in each row to view/download Click on column heading to sort the list You may be able to enter information on forms before saving or printing Downloading and printing File formats View and/or save documentsInstructions for Forms 1094B and 1095B Form 1094C Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Returns Inst 1094C and 1095C Instructions for Forms 1094C and 1095C Form 1095A Health Insurance Marketplace Statement Inst 1095A

Irs Issues Draft Form 1095 C For Aca Reporting In 21

Irs Releases Final Forms And Instructions For Aca Reporting Brinson Benefits

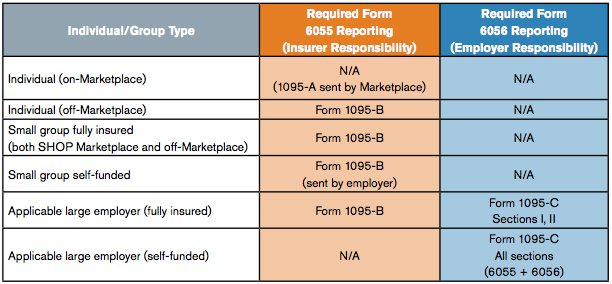

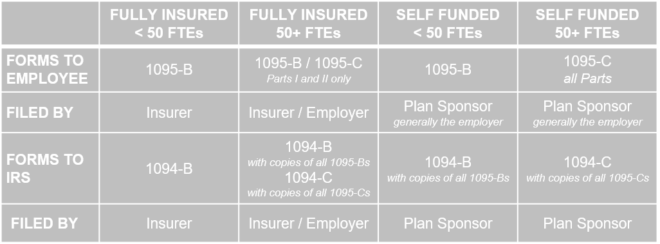

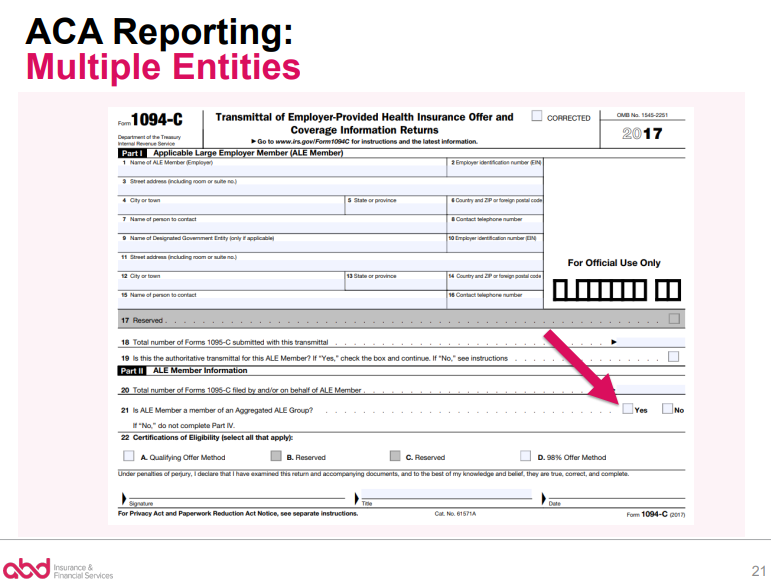

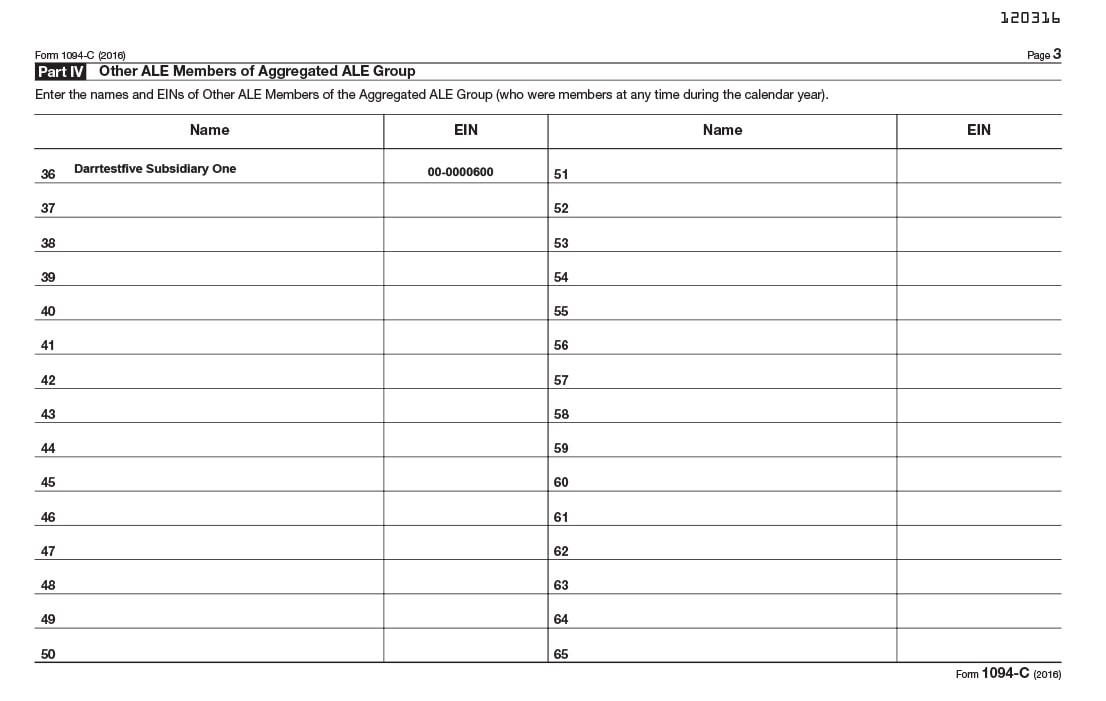

Although each ALE Member will list the other ALE Members on Part IV of Form 1094C as being a part of the same "Aggregated ALE Group" Reporting under Sections 6055 and 6056 involves one or both of two sets of forms the "BSeries" forms (Forms 1094B and 1095B) and the "CSeries" forms (Forms 1094C and 1095C)

Form 1095 A 1095 B 1095 C And Instructions

Irs Form 1095 C Codes Explained Integrity Data

Aca Reporting For Individual Coverage Hras

Www Techservealliance Org Wp Content Uploads 21 02 Irs Provides Additional Codes For Ichras Under Section Pdf

Irs Releases Final Forms And Instructions For Aca Reporting Brinson Benefits

1095 Software Ez1095 Affordable Care Act Aca Form Software

Understanding Part Ii And Part Iii For Form 1094 C 15 Boomtax Knowledge Base

Aca Employer Reporting Requirements 1094c 1095c Efile4biz

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

Form 1095 C The Aca Times

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

Irs Final Aca Compliance Forms Now Available Bernieportal

2

2

Aca Employer Mandate And Reporting Rules When Acquiring A Non Ale Newfront Insurance And Financial Services

Ez1095 Software How To Print Form 1095 C And 1094 C

2

Instructions For Forms 1095 C Taxbandits Youtube

1095 C Form Official Irs Version Discount Tax Forms

Irs Form 1095 C Codes Explained Integrity Data

Aca Forms 1094 C And 1095 C And Reporting Instructions For The Aca Times

Guide To Prepare Irs Aca Form 1094 C Form 1094 C Step By Step Instructions

Need To Correct An Irs 1094 C Or 1095 C Form

Instructions For Aca Reporting Released Sequoia

1

What You Need To Know About The Aca Instructions

1094 C Transmittal Of Employer Provided Health Insurance 1095c Coverage Info Returns 3 Sheets Form 100 Forms Pack

Form Irs 1094 C Fill Online Printable Fillable Blank Pdffiller

Irs Announces Changes With Aca Reporting Forms And Instructions Onedigital

Amazon Com Form 1095 C Health Coverage And Envelopes With Aca Software Includes 6 1094 B Transmittal Forms Pack For 100 Employees Office Products

Guide To Prepare Irs Aca Form 1094 C Form 1094 C Step By Step Instructions

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

The 19 Aca Reporting Is Due In Early Final Forms And Instructions Released Narfa

1094 C 1095 C Software 599 1095 C Software

Control Files And Sample Forms

Instructions For Forms 1094 C And 1095 Cand Calcpa Health Trusted Health Plans For Cpas

The Irs Releases Final 1094 C 1095 C Forms And Instructions For 18 Tax Year Foster Foster

trix Irs Forms 1095 C

Irs Releases Instructions And Draft Form 1094 C And 1095 C Basic

Irs Releases Final Forms And Instructions For Aca Reporting Brinson Benefits

Irs Form 1095 C Instructions For 21 Step By Step Filing Guide

Irs Releases Draft 19 Aca Reporting Forms And Instructions Sig

1095 C 1094 C Aca Software To Create Print E File Irs Form 1095 C

Tmlhealthbenefits Org Forms Tml Displaydoc Aspx Doc Id 694 Form Webinar

The Instructions For Forms 1094 C And 1095 C Blog Taxbandits

Irs Release Drafts Of Irs Forms 1094 C And 1095 C The Aca Times

Changes Coming For 1095 C Form Tango Health Tango Health

Employers Are You Unsure Of The Coding On Forms 1094 C And 1095 C The Aca Times

Aca Software Hrdirect

Irs Releases Forms 1094 1095 And Related Instructions Including New Rules For Ichra Reporting

Irs Form 1094 C Download Fillable Pdf Or Fill Online Transmittal Of Employer Provided Health Insurance Offer And Coverage Information Returns Templateroller

1095 C Form 21 Irs Forms

Ty Draft Forms 1095 C And 1094 C Released Along With New Form 1095 C Codes Press Posts

Updated Irs Reporting Requirements Babb Insurance

Irs Form 1094 C Form 1094 C Online 1095 C Transmittal Form

Common Mistakes In Completing Forms 1094 C And 1095 C

1095 C Preprinted Portrait Version With Instructions On Back

State Individual Mandates Add To Employer Reporting Responsibilities Foster Foster

Www Irs Gov Pub Irs Pdf P5223 Pdf

Affordable Care Act Aca Reporting Cheat Sheet Reporting Made Easy Onedigital

Www Irs Gov Pub Irs Prior Ib 19 Pdf

Irs Extends Due Date For Employers To Issue Health Coverage Forms In 18 News Illinois State

2

2

The Instructions For Forms 1094 C And 1095 C Blog Taxbandits

Guide To Prepare Irs Aca Form 1094 C Form 1094 C Step By Step Instructions

1094 C 1095 C Software 599 1095 C Software

trix Irs Forms 1094 C

Changes Coming For 1095 C Form Tango Health Tango Health

Www Lawleyinsurance Com Wp Content Uploads 11 1095 C Reporting Information Pdf

Aca Reporting Requirements Aca Compliance Aps Payroll

Irs Releases Final Forms 1094 1095 And Instructions Employers Council Blog

Form 1095 A 1095 B 1095 C And Instructions

A Z Important Terms To Know For Forms 1094 1095 C Ts1099 Ts1099

Www Fairviewinsurance Com Index Htm Files Irs releases additional section 6056 codes for ichras Pdf

:max_bytes(150000):strip_icc()/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

0 件のコメント:

コメントを投稿